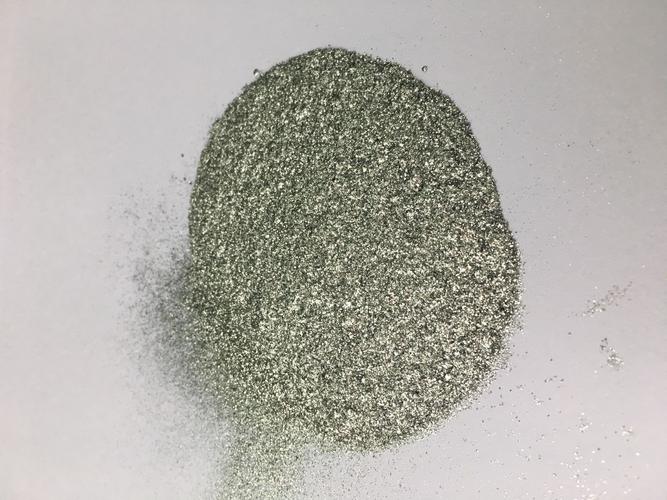

Copper powder is a form of solid copper that can be separated from its liquid form through heat treatment, resulting in small, uniform particles. It is often used as a refractory material, meaning it can withstand high temperatures without breaking down.

(is copper powder traded on a metals exchange)

There are several ways that copper powder can be traded on a metals exchange. One common way is through the metal trading market, which is a regulated market where different traders buy and sell different types of metals based on their price. For example, a trader might buy copper powder for use in a furnace, while another trader might sell it to extract precious metals from a mine.

Another way that copper powder can be traded on a metals exchange is through the spot market, which is a live market where traders buy and sell raw materials in real-time based on their current price. This allows traders to buy or sell copper powder at the current market price rather than having to wait for prices to rise or fall.

It is important to note that copper powder can also be traded through futures contracts, which are agreements between buyers and sellers to buy or sell a specific amount of at a predetermined price within a specified time period. Futures contracts can provide greater predictability and security than spot markets, but they also carry more risks.

(is copper powder traded on a metals exchange)

Overall, copper powder is a versatile and widely used material that can be found in many industries. Its trading on a metals exchange provides opportunities for traders to buy and sell this material in a controlled and regulated environment. Whether through spot markets or futures contracts, understanding how to trade copper powder can help investors make informed decisions about their investment portfolios.